Products

Company

Consumer

Products built to simplify and automate borrowing.

Business

Products built to power seamless marketing.

Newsstand

The latest updates and insights from our team.

Resources

Helpful tools to get your questions answered.

Student Loan Refinance

Receive personalized rates with 17+ lenders to refinance your student loans through a single form in as little as three minutes.

How much money are you looking for?

Select your citizenship status

Indicate all your degrees

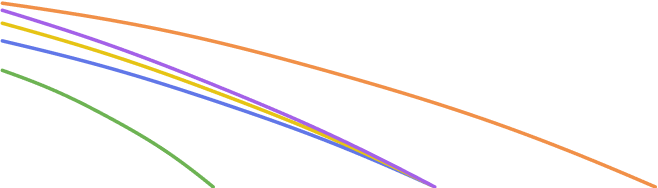

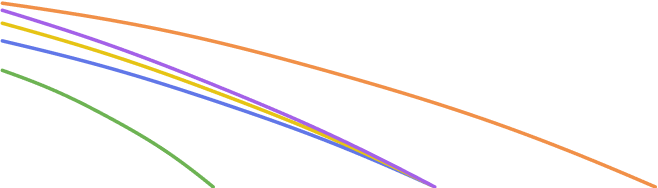

APR 5.03% ∙ 10 years

APR 5.03% ∙ 15 years

APR 5.03% ∙ 20 years

Illustrative purposes, actual results may vary.

Personalized rates are not a firm offer of credit.

We don’t believe in charging borrowers for our services. Sparrow’s products are free and always will be.

Sparrow doesn’t impact your credit score or go on your credit report. We remove the risk of shopping real rates with lenders.

Sparrow works with the nation’s largest network of private student lenders to find you the best rate out there.

No smoke and mirrors. No mystery. We don’t get paid to rank lenders higher. You see real personalized rates before selecting a lender.

Illustrative purposes, actual results may vary.

Personalized rates are not a firm offer of credit.

Radically simplify your student loan refinancing. Leverage the most powerful search engine to do the work for you.

Illustrative purposes, actual results may vary.

Personalized rates are not a firm offer of credit.

Once you have found the best personalized rate for you, click Apply and we’ll take you to the right place.

Get out of debt ASAP (personalized rates with the shortest terms) Change my preferences

There’s a reason Sparrow’s the fastest growing platform for borrowers looking to refinance their student loans, see for yourself.

Find my rateLast year, Sparrow facilitated the search of over $1 billion in student loan volume.

Sparrow supports 7,000+ schools. No degree? No problem. You’re still eligible to refinance.

Exhaustively search for the best student loan refinancing options and effortlessly compare your personalized rates - all in one place.

Find my rateIllustrative purposes, actual results may vary.

Personalized rates are not a firm offer of credit.

Illustrative purposes, actual results may vary.

Personalized rates are not a firm offer of credit.

Tired of seeing rate ranges and not knowing where you fall in the range? Sparrow allows you to compare real student loan refinancing rates through a single form. Think of Sparrow as the Expedia of student loan refinancing.

With Sparrow, you can compare real repayment plans from multiple lenders side-by-side so you know exactly how each loan stacks up when it comes to APR, monthly repayment, total repayment amount, and repayment options.

Refinancing your student loans means you’re essentially trading in your current student loan(s) for a newer one – often with a new principal and a different interest rate. Your lender uses the newer loan to pay off the old one(s), so you’re left with just one loan and one monthly payment.

There are several reasons why you might want to refinance, including:

We’ve hand-selected our lending partners to offer maximum coverage and ensure that every borrower has an opportunity to find affordable refinancing on Sparrow.

While criteria varies by lender, in general, you need a good credit score (in the high 600s or above) and a stable income of at least $24,000 to be eligible to refinance your student loans with private lenders.

To determine your eligibility, complete our three minute application form and, if you’re eligible, you’ll instantly receive personalized rates on your Dashboard.

Yes, some of our lending partners provide options for borrowers with eligible student loans who didn’t graduate and are no longer enrolled in school.

Yes, some of our lending partners allow you to refinance while you’re still in school. With that said, most lenders require you to have graduated in order to be eligible to refinance.

Our lending partners will refinance both federal and private student loans. You may refinance student loans for which you’re either the primary borrower or cosigner.

If you’re refinancing federal loans, please be aware that your federal benefits may not transfer to private lenders when you refinance.

Our lending partners determine interest rates by looking at the following factors (among other criteria):

The refinancing limit varies from lender to lender, but most lenders require a minimum loan size of $5,000 and a maximum loan size of $500,000. Higher loan sizes may only be available to borrowers meeting certain criteria (stable income and high credit score).

If you’re interested in refinancing your federal student loans, the first step is to check your rate with Sparrow!

Checking your rate will give you an understanding of the new interest rates and monthly payment options available to you by refinancing through our lending partners.

Checking your rate with Sparrow doesn’t impact your credit score. If refinancing makes sense for your situation, you can complete the rest of your online application and start saving.

You can refinance your student loans as often as you’d like! Requesting refinancing on Sparrow is completely free and doesn’t impact your credit score.

We recommend refinancing if your credit score or income increases significantly, or if interest rates go down. These are signs that you could receive a loan with lower interest rates, which could help you save thousands on your student loans.

No, there are zero fees to use Sparrow. Sparrow is completely free for all borrowers.

Some lenders require that loans be out of forbearance or deferment and others don’t. Filling out Sparrow’s free three minute form will help you figure out which, if any, lenders you’re eligible with.

Yes! International borrowers can use Sparrow to receive pre-qualified rates from 17+ different lenders. Two of our lending partners focus specifically on international student loans, and several other lenders allow international students to borrow if they have a qualified cosigner.

We partner with four types of student loan refinancers: (i) banks (ii) financial technology companies (iii) credit unions and (iv) state agencies. The broader the network of lenders, the more competitive the rates.

Our lending partners offer private student loans for undergraduate and graduate degrees with repayment terms from 5 to 20 years. You can find out more about our lending partners by reading the lender reviews on Sparrow Articles.

Student loan refinancing may take anywhere from a few days to a few weeks, depending on whether the lender requests additional information from you.

Once you’re approved for refinancing, the private lender will pay off your federal loan(s) in full and issue you a single new loan, with a new interest rate.

When refinancing, lenders disburse the funds directly to your previous lender/servicer directly.

You’re not required to have a cosigner to use Sparrow. However, if you’ve a limited or poor credit history and minimal income, adding a creditworthy cosigner can improve your chances of qualifying for a loan.

Just like for borrowers, it takes just three minutes for a cosigner to include themselves on a pre-qualification request.